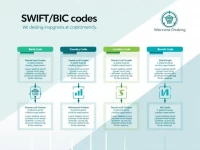

Rbcs SWIFTBIC Code Guide for Global Transfers

This article provides a detailed analysis of the SWIFT/BIC code ROYCCAT2HIC for the Royal Bank of Canada, highlighting its significance in the international remittance process. It also includes the bank's address and key considerations for remittance, aiming to assist users in safely and efficiently completing cross-border financial transactions.